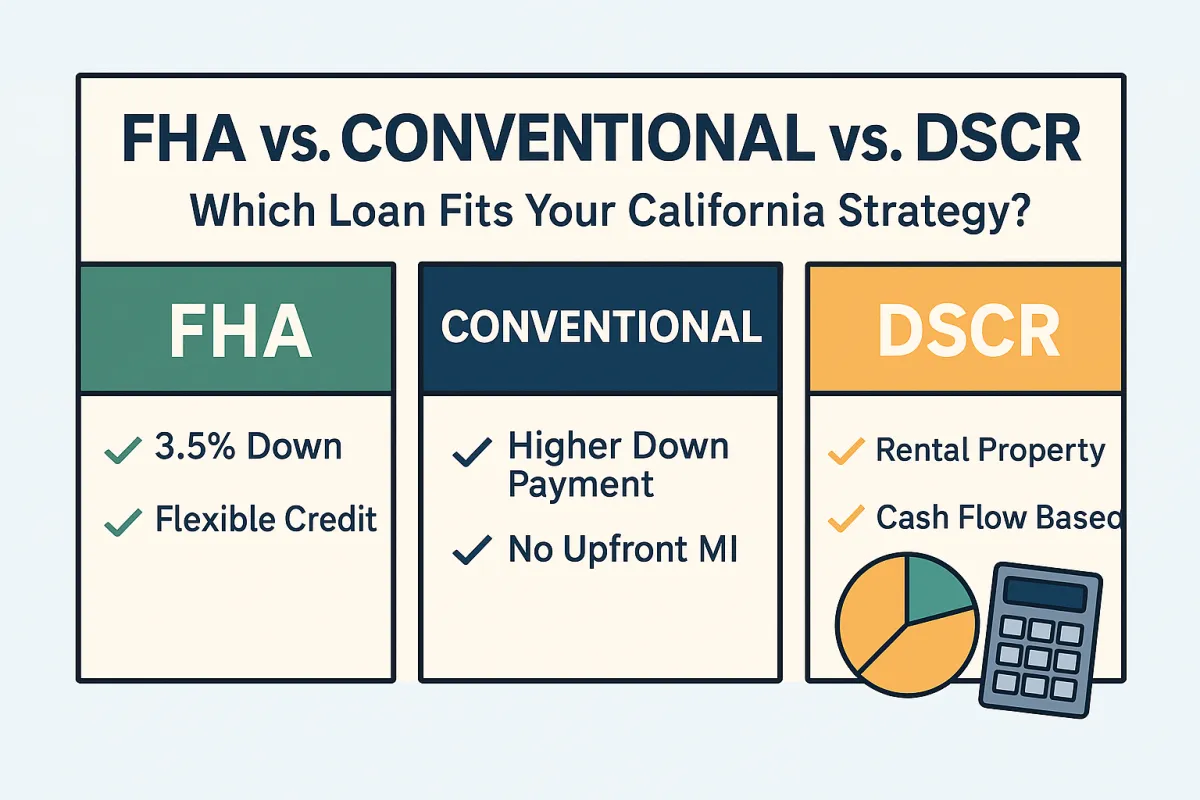

FHA vs. Conventional vs. DSCR Which Loan Fits Your California Strategy?

FHA, Conventional, or DSCR? Here’s What Actually Makes Sense in Today’s California Market

If you're trying to buy in California right now, the biggest decision isn't just the house it’s the loan you use to get it.

With rising inventory and a mixed-interest-rate environment, buyers need to structure smart from day one. So let’s break it down: FHA vs. Conventional vs. DSCR. Which is right for you?

🟩 FHA Loans (Great for First-Time Buyers or Lower FICO)

If your credit is in the 620–680 range, or your down payment is tight, FHA is still one of the most powerful tools especially in markets like Riverside, San Bernardino, and Long Beach.

Why FHA might make sense:

3.5% down payment

Flexible debt-to-income ratios

More forgiving on credit history

Seller credits allowed (great for buying down your rate)

Watch out for: Upfront mortgage insurance + monthly MI (unless you plan to refinance later).

🟦 Conventional Loans (Best for 680+ FICO and Strong Income)

If your FICO is solid and you can put at least 5 - 10% down, conventional gives you more control long term.

Why go conventional:

No upfront mortgage insurance

MI drops off once you reach 20% equity

More competitive for higher-priced homes (especially above FHA limits)

Tip: Seller credits are still allowed but often capped at 3% unless you go higher down payment.

🟧 DSCR Loans (For Investors and Self-Employed Buyers)

Not buying for your primary residence? DSCR (Debt Service Coverage Ratio) loans are built for rental property buyers or self-employed borrowers who want to qualify based on property cash flow, not personal income.

Why investors love DSCR:

No income docs needed

Qualify based on rental income

Can close in an LLC or trust

Great for short-term rentals, flips, or long-term buy & holds

Heads up: Down payments typically start at 20 - 25%, and rates are slightly higher but it’s fast money if the deal pencils.

🎯 So… What’s Your Strategy?

Choosing the right loan type isn't just about qualification it's about cash flow, risk, and long-term ownership strategy. Here's how I help:

✅ Scenario planning (real numbers, not guesses)

✅ Rate buydown vs. closing cost comparisons

✅ Real conversations not sales pitches

👇 Want clarity on your numbers?

Connect in 60 seconds, no commitment, just clarity.

🔗 Get Started